Credit Spring Login – Navigating Financial Resilience

In the complex landscape of personal finance, Credit Spring emerges as a pivotal platform designed to empower individuals on their journey to financial resilience. The Credit Spring login serves as the gateway to a suite of tools and resources aimed at providing users with valuable insights into their credit health, personalized financial guidance, and access to credit-building strategies. This guide delves into the Credit Spring login process, explores the features that define this platform, and celebrates its role in fostering financial well-being.

Credit Spring – Cultivating Financial Wellness

Credit Spring is more than just a credit management platform; it’s a partner in cultivating financial wellness. Recognizing the significance of credit in various aspects of life, Credit Spring is dedicated to helping users understand, build, and leverage their credit responsibly. The platform operates on the principle that financial empowerment begins with knowledge and strategic planning.

The Credit Spring Login Portal – Your Financial Command Center

The Credit Spring login portal serves as the financial command center for users seeking to take control of their credit journey. Whether logging in through a web browser or a mobile app, the portal is designed for user-friendly navigation, offering a holistic view of one’s credit profile and financial standing.

Streamlined User Experience – Navigating with Ease

Credit Spring prioritizes a streamlined user experience within its login portal. The interface is designed to be intuitive, ensuring that users, regardless of their familiarity with financial terminology, can navigate with ease. From credit score insights to personalized recommendations, every feature is accessible in a straightforward manner.

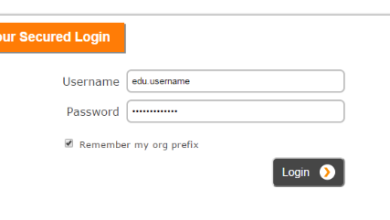

Secure Access – Safeguarding Financial Information

Security is paramount when it comes to financial platforms, and Credit Spring places a strong emphasis on secure access. The login portal employs cutting-edge encryption technologies and multi-factor authentication to safeguard users’ sensitive financial information. This commitment to security aims to instill confidence in users as they engage with their credit data.

Credit Profile Overview – Insight into Financial Health

Upon logging in, users are greeted with a comprehensive overview of their credit profile. Credit Spring provides insights into credit scores, factors influencing scores, and a breakdown of credit accounts. This feature serves as a starting point for users to assess their financial health and understand areas for improvement.

Personalized Credit Recommendations – Tailored Strategies

Credit Spring goes beyond providing credit scores; it offers personalized credit recommendations based on individual profiles. Whether it’s guidance on debt reduction, credit utilization, or strategic credit-building initiatives, the platform tailors its recommendations to align with users’ unique financial circumstances and goals.

Credit-Building Tools – Constructing a Strong Foundation

Understanding that credit-building is a journey, Credit Spring introduces a suite of credit-building tools within the login portal. Users can explore resources on responsible credit use, debt management strategies, and proactive steps to enhance their credit standing. This educational component empowers users to actively participate in shaping their financial future.

Credit Monitoring and Alerts – Real-Time Awareness

Staying informed about changes in one’s credit profile is crucial. Credit Spring incorporates robust credit monitoring features, sending real-time alerts to users about significant changes in their credit reports. Whether it’s a new account opening, a credit inquiry, or a change in credit utilization, users receive timely notifications to stay in control.

Goal Setting and Tracking – Financial Aspirations

Credit Spring encourages users to set financial goals, whether it’s achieving a specific credit score, paying off debts, or saving for a major purchase. The login portal includes tools for users to set, track, and celebrate their financial milestones. This goal-oriented approach adds a motivational aspect to the credit management journey.

Credit Education Center – Knowledge as Power

Recognizing that financial literacy is a cornerstone of sound credit management, Credit Spring features a Credit Education Center accessible through the login portal. Users can explore articles, tutorials, and interactive resources covering a range of topics, from understanding credit reports to navigating the nuances of credit scoring models.

Credit Counseling Services – Professional Guidance

For users seeking personalized guidance, Credit Spring may offer credit counseling services accessible through the login portal. These services provide an opportunity for users to engage with certified credit counselors, receive one-on-one advice, and develop customized strategies to address specific financial challenges.

Credit Spring Community – Shared Experiences

The platform fosters a sense of community among users through forums, discussion boards, and shared experiences accessible via the login portal. Users can connect with others on similar credit journeys, share success stories, and seek advice. This community-centric approach creates a supportive environment where users feel encouraged and motivated in their financial endeavors.

Credit Score Simulators – Strategic Planning

To empower users with foresight, Credit Spring introduces credit score simulators within the login portal. These tools allow users to simulate potential financial actions, such as opening a new credit account or paying off a debt, to understand the potential impact on their credit scores. This strategic planning feature enables users to make informed decisions about their financial moves.

Financial Product Marketplace – Informed Choices

Credit Spring may incorporate a Financial Product Marketplace within the login portal, providing users with insights into credit cards, loans, and other financial products. This feature aims to help users make informed choices by presenting options that align with their credit profiles and financial goals.

Personal Finance Tracking – Beyond Credit Scores

While credit management is a focal point, Credit Spring recognizes the interconnected nature of personal finance. The login portal may include features for users to track income, expenses, and overall financial health. This comprehensive approach ensures that users have a holistic view of their financial well-being.

Enhanced Credit Dispute Services – Advocating for Users

Understanding that inaccuracies on credit reports can impact scores, Credit Spring may offer enhanced credit dispute services within the login portal. Users can initiate and track disputes, ensuring that inaccuracies are addressed promptly and advocating for the accuracy of their credit information.

Accessibility Across Devices – Financial Empowerment Anywhere

Credit Spring ensures accessibility across devices, allowing users to engage with their financial information whether they are using a computer, tablet, or smartphone. This multi-device accessibility ensures that users can stay connected to their financial journey from anywhere, fostering a continuous and convenient user experience.

Continuous Innovation – Adapting to User Needs

As user needs evolve and financial landscapes change, Credit Spring is committed to continuous innovation. The login portal serves as a dynamic space where new features, tools, and resources are introduced to align with emerging trends and user feedback. This commitment to adaptability ensures that Credit Spring

Youremains at the forefront of the ever-changing landscape of personal finance, consistently meeting the evolving needs of its users.

Credit Spring Mobile App – Financial Power in Your Pocket

Recognizing the prevalence of mobile devices in our daily lives, Credit Spring extends its reach with a dedicated mobile app accessible through the login credentials. The mobile app provides a seamless and optimized experience, allowing users to manage their credit health, set goals, and receive real-time alerts on the go. This mobile extension enhances the accessibility and convenience of Credit Spring’s offerings.

Ginancial Wellness Webinars – Educational Empowerment

Complementing the Credit Education Center, the login portal may feature financial wellness webinars. These webinars offer live or recorded sessions on topics such as budgeting, investing, and debt management. Users can engage with experts, ask questions, and deepen their financial knowledge, fostering a culture of continual learning within the Credit Spring community.

Integration with Budgeting Tools – Holistic Financial Management

Credit Spring may integrate with popular budgeting tools within the login portal. This integration allows users to synchronize their credit information with budgeting platforms, creating a cohesive approach to financial management. Users can track spending, set budgetary goals, and align their credit strategies with broader financial objectives.

Credit Spring Rewards Program – Incentivizing Responsible Financial Habits

In a bid to motivate and reward responsible financial behavior, Credit Spring may introduce a rewards program accessible through the login portal. Users earn points or benefits for achieving credit-related milestones, practicing good financial habits, and engaging with educational resources. This gamification element adds a layer of enjoyment to the credit management journey.

Multi-Lingual Support – Serving a Diverse User Base

Recognizing the diversity of its user base, Credit Spring ensures multi-lingual support within the login portal. Users can select their preferred language, breaking down language barriers and making financial resources more accessible to a broader audience. This commitment to inclusivity aligns with Credit Spring’s mission of empowering individuals from all walks of life.

Credit Spring Blog – Timely Insights and Tips

The login portal may feature an integrated blog, offering timely insights, tips, and industry updates. The Credit Spring blog becomes a valuable resource for users looking to stay informed about the latest trends in credit management, financial planning, and economic shifts. Regularly updated content keeps users engaged and well-informed.

User Testimonials and Success Stories – Inspiring Confidence

To inspire confidence and motivate others, the login portal may showcase user testimonials and success stories. Real accounts of individuals who have achieved positive outcomes through Credit Spring’s guidance serve as beacons of inspiration, reinforcing the idea that financial resilience is achievable with the right tools and strategies.

Social Media Integration – Community Connectivity

Credit Spring recognizes the importance of social connectivity. The login portal may integrate with social media platforms, allowing users to share their achievements, participate in discussions, and connect with the larger Credit Spring community. Social media integration fosters a sense of camaraderie and provides an avenue for users to support each other in their financial journeys.

Future Financial Planning Tools – Anticipating User Needs

As financial needs evolve, Credit Spring anticipates future trends by introducing innovative financial planning tools within the login portal. These tools may include predictive analytics, retirement planning calculators, and investment scenario simulators. By offering forward-looking resources, Credit Spring positions itself as a forward-thinking ally in users’ long-term financial planning.

Partnership Discounts and Offers – Maximizing Value

The login portal may feature a section dedicated to partnerships with various financial institutions and service providers. Users can access exclusive discounts, offers, or perks through these partnerships, maximizing the overall value they derive from their association with Credit Spring. This value-added component enhances the attractiveness of Credit Spring as a comprehensive financial platform.

Credit Spring Customer Support Hub – Responsive Assistance

Recognizing that users may have questions or require assistance, the login portal includes a customer support hub. Users can access FAQs, engage in live chat support, or submit queries directly through the portal. This responsive customer support system ensures that users feel supported and valued throughout their Credit Spring experience.

Financial Empowerment Challenges – Fostering Healthy Competition

To inject an element of healthy competition and motivation, Credit Spring may introduce financial empowerment challenges accessible through the login portal. Users can participate in challenges that encourage positive financial habits, with rewards for those who meet specific milestones. These challenges foster a sense of community and create a fun, engaging dimension to the financial wellness journey.

Conclusion: Credit Spring Login – Your Path to Financial Resilience

In conclusion, the Credit Spring login portal is not just an entry point; it’s a gateway to financial resilience, empowerment, and well-being. Through its user-friendly interface, robust security measures, and a wealth of features, Credit Spring provides a comprehensive platform for individuals to understand, build, and leverage their credit effectively. The continuous innovation, educational resources, and community-centric approach make Credit Spring a guiding force in the realm of personal finance. As users log in to Credit Spring, they embark on a transformative journey toward financial resilience, armed with knowledge, personalized guidance, and a supportive community to accompany them every step of the way.

Also Read: https://primenewsartical.com/