Empowering Financial Access: Navigating the World of Citibank Login

In an era marked by digital transformations and the growing importance of online financial services, Citibank stands as a prominent institution with a global presence. This comprehensive exploration delves into the intricacies of Citibank Login, unraveling its features, security measures, and the broader impact it has on shaping the financial experiences of individuals and businesses around the world.

Chapter 1: Citibank’s Legacy – A Global Financial Giant

The origins of Citibank can be traced back to the early 19th century, and its evolution mirrors the changing landscapes of international finance. From its roots in New York City, Citibank has expanded its reach to become a global financial giant, serving millions of customers across diverse markets. Its legacy is characterized by a commitment to innovation, financial expertise, and a dedication to meeting the evolving needs of its clientele.

Chapter 2: The Digital Era – Citibank’s Transition to Online Banking

As technology became integral to daily life, Citibank embraced the digital era by transitioning to online banking. The introduction of Citibank Login marked a significant shift, offering customers the convenience of accessing their accounts, conducting transactions, and managing finances from the comfort of their homes or on the go. This move aligned with the broader industry trend toward digitalization and a shift in customer preferences.

Chapter 3: Citibank Login – Gateway to Financial Control

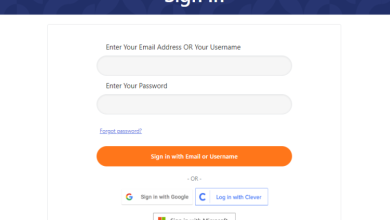

Citibank Login serves as the gateway through which account holders access a suite of financial services. This secure online portal empowers users to manage various aspects of their financial lives, from checking account balances to initiating fund transfers, paying bills, and gaining insights into transaction histories. The login interface encapsulates simplicity, functionality, and a commitment to user-friendly navigation.

Chapter 4: Security Measures – Safeguarding User Information

As a custodian of sensitive financial data, Citibank places a premium on security measures within its login framework. Multi-factor authentication, encryption protocols, and continuous monitoring are integral components of Citibank’s security infrastructure. The institution’s proactive approach to safeguarding user information underscores its commitment to building trust in the digital financial realm.

Chapter 5: Multi-Platform Accessibility – Banking Anytime, Anywhere

Citibank Login transcends traditional banking hours and physical branch limitations, offering multi-platform accessibility. Whether through a web browser on a desktop, a dedicated mobile app, or other digital channels, users can access Citibank’s suite of services 24/7. This accessibility aligns with the modern lifestyle, where individuals value the flexibility to manage their finances at any time and from anywhere.

Chapter 6: Account Overview – A Comprehensive Financial Snapshot

Upon logging in, Citibank users are greeted with an account overview, providing a comprehensive snapshot of their financial landscape. This interface typically displays account balances, recent transactions, and, in some cases, personalized insights into spending patterns. The goal is to offer users a quick and informative glance at their financial standing, promoting financial awareness and informed decision-making.

Chapter 7: Transaction Capabilities – Seamless Fund Management

Citibank Login facilitates seamless transaction capabilities, allowing users to conduct a spectrum of financial activities. From transferring funds between accounts to paying bills, setting up automatic payments, and even initiating international wire transfers, users can orchestrate a myriad of transactions through the secure digital portal. The intuitive design aims to simplify complex financial tasks, making them accessible to users with varying levels of financial literacy.

Chapter 8: Mobile Banking – Banking in the Palm of Your Hand

The advent of mobile banking has revolutionized the way individuals interact with their finances. Citibank’s mobile app, an extension of the online portal, brings banking directly into the palm of users’ hands. Mobile banking through Citibank Login allows for on-the-go account management, mobile check deposits, and real-time transaction monitoring, enhancing the overall banking experience for users with busy, mobile-centric lifestyles.

Chapter 9: Alerts and Notifications – Real-Time Financial Insights

Citibank Login incorporates a robust system of alerts and notifications, empowering users with real-time insights into their financial activities. Whether it’s a notification for a large transaction, a low account balance, or a reminder for an upcoming bill, these alerts contribute to financial awareness and help users stay in control of their financial lives.

Chapter 10: Rewards and Loyalty Programs – Incentivizing Financial Engagement

To incentivize customer engagement, Citibank integrates rewards and loyalty programs into its online platform. Through the login interface, users can track their rewards points, explore redemption options, and take advantage of exclusive offers tied to their banking activities. This approach not only enhances customer retention but also adds an element of gamification to the banking experience.

Chapter 11: Customer Support – A Human Touch in a Digital Realm

While the digital interface empowers users with self-service capabilities, Citibank understands the importance of maintaining a human touch in customer support. The login portal often provides access to customer service channels, including live chat, phone support, and a comprehensive knowledge base. This ensures that users have avenues for assistance and guidance whenever needed.

Chapter 12: Specialized Services – Tailoring Banking Experiences

Citibank Login extends beyond basic banking functions, offering access to specialized services. These may include wealth management tools, investment platforms, mortgage services, and more. The login interface serves as a portal to a spectrum of financial offerings, allowing users to explore and engage with services that align with their broader financial goals.

Chapter 13: Global Connectivity – Banking Across Borders

For users with international financial interests, Citibank’s global connectivity becomes a pivotal feature. The login portal seamlessly integrates accounts from different regions, offering users a unified view of their global financial portfolio. This interconnectedness simplifies international fund transfers, currency exchanges, and provides a cohesive financial management experience for globally mobile individuals and businesses.

Chapter 14: Continuous Innovation – Adapting to Changing Needs

The landscape of digital finance is ever-evolving, and Citibank recognizes the need for continuous innovation. The login interface serves as a dynamic platform through which new features, technologies, and financial tools are introduced. This commitment to innovation ensures that Citibank remains at the forefront of the digital banking realm, adapting to changing user needs and technological advancements.

Chapter 15: Financial Education Resources – Empowering Financial Literacy

Citibank Login goes beyond transactional capabilities, offering access to financial education resources. These resources may include articles, webinars, and tools designed to enhance financial literacy. By empowering users with knowledge about budgeting, investing, and other financial topics, Citibank contributes to a more informed and financially literate user base.

Chapter 16: Challenges and Considerations – Navigating the Digital Landscape

While Citibank Login offers a myriad of benefits, there are challenges and considerations that users and the institution itself must navigate. Issues such as cybersecurity threats, user privacy concerns, and potential disruptions in digital services are part of the landscape that both users and Citibank must remain vigilant about. Cybersecurity measures and ongoing updates to the digital infrastructure are paramount to ensure the protection of user data and maintain the trust of a global customer base.

Chapter 17: Future Outlook – Fintech Integration and Beyond

Looking ahead, the future outlook for Citibank Login involves further integration with fintech innovations. As the financial technology landscape evolves, Citibank is poised to explore collaborations, partnerships, and the integration of emerging technologies such as blockchain and artificial intelligence. These advancements could redefine the digital banking experience, offering users even more sophisticated tools and services through the login interface.

Chapter 18: Regulatory Compliance – Upholding Standards

In the ever-changing landscape of financial regulations, Citibank navigates a complex web of compliance standards. The login interface serves as a portal through which users engage with compliant financial services. Staying abreast of regulatory changes and proactively adapting the login platform to meet evolving compliance requirements is crucial for Citibank to maintain its standing as a trusted financial institution.

Chapter 19: User Feedback and Iterative Improvements – A Collaborative Approach

User feedback plays a pivotal role in the iterative improvements of Citibank Login. The institution encourages users to provide insights, suggestions, and feedback about their digital banking experiences. This collaborative approach ensures that the login interface evolves in response to user needs, preferences, and emerging trends, fostering a sense of ownership and partnership between Citibank and its customers.

Chapter 20: Social Impact – Financial Inclusion and Accessibility

Beyond individual user experiences, Citibank Login contributes to broader social impact by promoting financial inclusion and accessibility. The digital platform provides individuals from diverse socio-economic backgrounds with access to essential banking services, empowering them to manage their finances more effectively. This aligns with Citibank’s commitment to being a responsible corporate citizen with a positive impact on the communities it serves.

Chapter 21: Citibank’s Ecosystem – Beyond the Login

While Citibank Login is a gateway to a wide array of financial services, the institution’s ecosystem extends beyond the digital login interface. Citibank’s physical branches, ATMs, and network of partners contribute to a comprehensive financial ecosystem. The login interface seamlessly integrates with these physical touchpoints, providing users with a holistic banking experience that combines the convenience of digital access with the availability of in-person services.

Chapter 22: Industry Collaborations – Shaping the Financial Landscape

Citibank actively engages in collaborations within the financial industry to shape the future of banking. These collaborations may involve partnerships with other financial institutions, technology companies, and regulatory bodies. By participating in industry dialogues and collaborative initiatives, Citibank contributes to the collective efforts aimed at advancing financial services, ensuring interoperability, and fostering innovation.

Chapter 23: Case Studies – Realizing Financial Goals

Examining real-world case studies sheds light on how individuals and businesses have leveraged Citibank Login to realize their financial goals. These case studies showcase diverse scenarios, from personal financial management to corporate financial strategies, illustrating the versatility and impact of Citibank’s digital banking platform in addressing unique financial needs.

Conclusion: Navigating Financial Horizons with Citibank Login

In conclusion, Citibank Login represents more than just a digital portal for accessing financial services; it symbolizes a dynamic intersection of technological innovation, financial expertise, and user-centric design. As users navigate their financial horizons through the login interface, they engage with a platform that transcends traditional banking, offering convenience, security, and a pathway to realizing their financial aspirations. The evolution of Citibank Login mirrors the broader narrative of digital transformation in the financial industry, where adaptability, collaboration, and a commitment to user empowerment define the trajectory toward a more connected and inclusive financial future.

Also Read: https://primenewsartical.com/